3D Investment Partners Boosts Stake in Square Enix to Over 16%: What It Means for the Future

- Sagar Mankar

- Dec 25, 2025

- 3 min read

Activist investor 3D Investment Partners has increased its stake in Square Enix to 16.48%, making it the second-largest shareholder in the company behind only Enix founder Fukushima, who holds 19.28%.

The Singapore-based investment firm has been steadily accumulating shares since April 2025, when it first disclosed a 5.47% stake in the Japanese gaming giant. What started as a relatively modest investment has grown substantially over the past eight months, with the firm continuously buying more shares and reaching the 10% threshold by mid-June. The latest acquisition pushes their ownership to over 16%, putting them in a powerful position to influence the company's direction.

For those unfamiliar with the term, "activist" investors are financial institutions that build significant stakes in publicly traded companies with the goal of pushing for major changes in management or business strategy. Unlike political activism, this is purely about maximizing shareholder value and returns. These firms typically target what they perceive as underperforming or poorly managed companies, buying enough shares to gain leverage in demanding reforms.

3D Investment Partners showed its hand earlier this month when it published a comprehensive 112-page presentation outlining what it sees as critical problems with Square Enix's management. The fund called on other shareholders to join them in providing frank feedback about the company's ongoing challenges. Their stated goal is to pursue constructive dialogue with Square Enix's leadership, though the tone of their presentation suggests growing frustration with the company's direction.

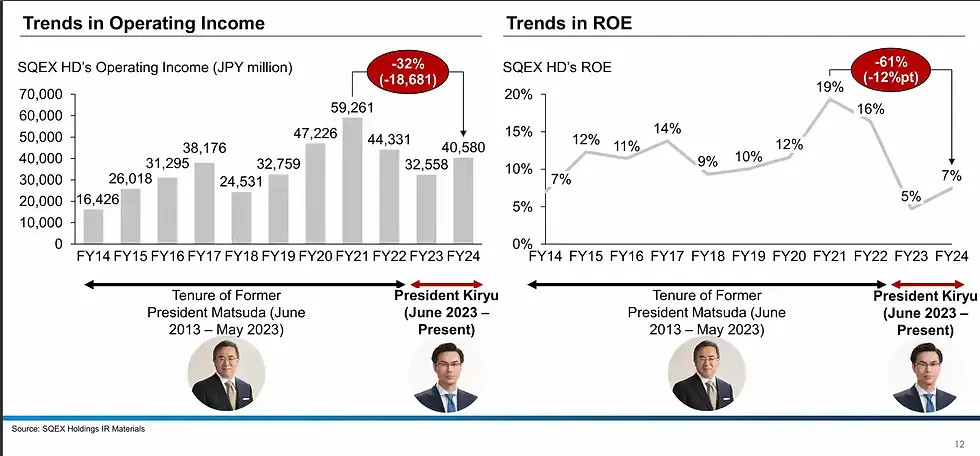

According to the presentation, Square Enix has been struggling with stagnant revenue growth and weak profit margins over the past three years, particularly when compared to industry peers like Nintendo, Capcom, Bandai Namco, and Konami. The activist fund points to underperformance in both console and mobile game sectors, along with exceptionally large write-downs from cancelled projects. They've even suggested that Square Enix's arcade and publishing divisions are "non-synergistic businesses" that drag down overall company value.

Last year, Square Enix announced a mid-term strategy plan spanning fiscal years 2025 through 2027, which the company has branded as a "reboot." The plan includes optimizing the development footprint, shifting from quantity to quality, and focusing on a multiplatform strategy for HD games, among other initiatives. However, 3D Investment apparently finds this plan insufficient and too vague. Their critique highlights a lack of concrete vision for long-term recovery, underwhelming improvement targets, and missing execution plans or key performance indicators for addressing the company's problems.

3D Investment also mentioned they approached Square Enix CEO Takashi Kiryu back in October with their analysis and proposed improvements. The response they received was apparently unsatisfying, consisting only of a brief email insisting the current plan was adequate. This lukewarm reception pushed the activist fund to go public with their concerns and rally other shareholders to their cause, a classic tactic in the activist investing playbook.

Industry analysts like Dr. Serkan Toto have suggested that, despite the mounting pressure, 3D Investment Partners is unlikely to directly interfere with Square Enix's game development pipeline. The fund has no experience in the video game or entertainment industry, making it improbable they would attempt to dictate creative decisions about franchises like Final Fantasy or Dragon Quest. Instead, experts believe the real target is Square Enix's substantial cash reserves, which stood at 237.6 billion yen as of December 2024. Activist investors typically push companies to use such reserves for share buybacks and other activities designed to boost stock prices and maximize returns for shareholders.

The situation mirrors the pressure faced by other Japanese gaming companies. Mobile game giant GungHo, for instance, has been dealing with similar demands from activist investor Strategic Capital, which has repeatedly called for the company's CEO to be fired through public announcements. GungHo has consistently rejected these proposals.

How Square Enix ultimately responds to 3D Investment Partners remains to be seen, but with the activist fund now controlling over 16% of shares and inching closer to the founder's stake, the pressure to engage meaningfully has never been higher.

Sources: Automoton, Genki, Serkan Toto, BusinessWire.

Comments